With over twenty years in alternative real estate investments, we hold a unique position as pioneers in the industry.

Our FOCUS

At Cornerstone Real Estate Investment Services, we understand the importance of shifting the focus from ourselves to you, the private real estate investor. We recognize the valuable insights you have to offer in constructing a real estate investment portfolio that aligns with your investment philosophy, life experiences, and unique goals. Our extensive experience working with accomplished clients has shown us that you have already embarked on a successful journey in your investment endeavors.

We are committed to putting you at the center of everything we do.

Your journey has provided you with experience from your career, knowledge of various geographic markets, perspectives on the impact of global warming, and investment philosophies that shape your preferences for leverage and loan amortization, among other factors.

Similarly, our own journey has equipped us with unparalleled industry experience, exceptional due diligence expertise, and a passion for tax shelter and risk diversification. We offer these valuable resources to you at no additional cost. We firmly believe that our collective experiences can create a powerful synergy in building an investment portfolio that compliments your journey toward a more prosperous and peaceful future.

We wrote the book on DSTs & QOZs.

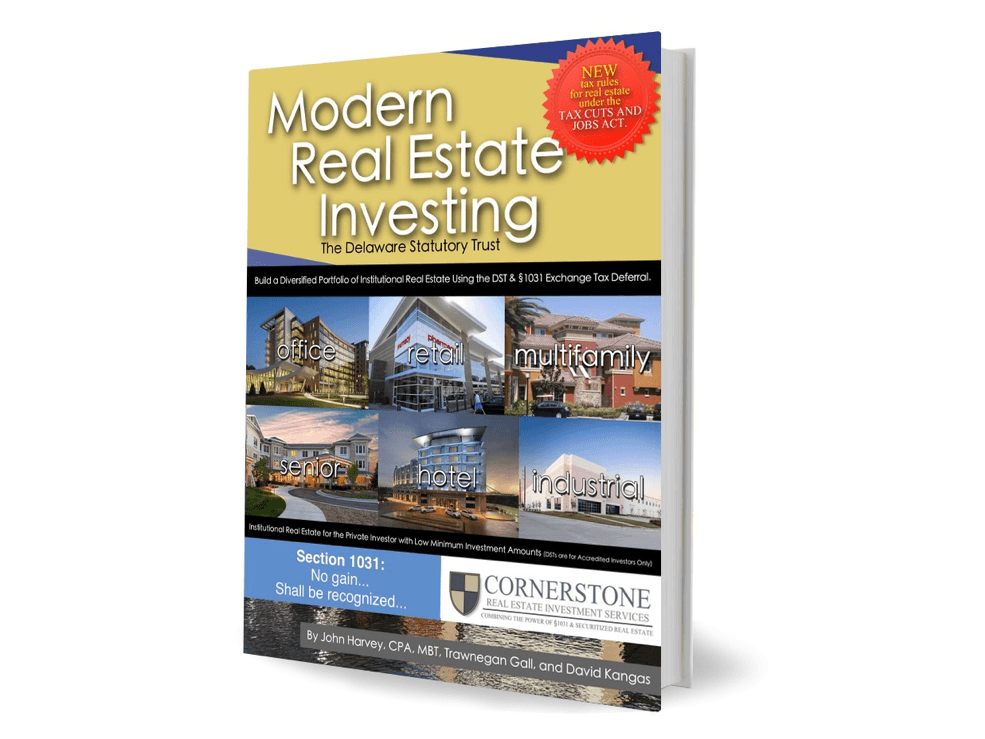

Modern Real Estate Investing

Modern Real Estate Investing introduces the nation to a new concept in real estate investment known as the Delaware Statutory Trust (DST). The DST is a synthesis of one hundred years of real estate, securities, and tax laws that provide an investment entity that allows the modern real estate investor to build a diversified portfolio of institutional grade real estate under protective securities regulations and enjoy the tax advantages of gain nonrecognition using IRC section 1031 like-kind exchanges. The book not only introduces the DST but also guides the reader through the investment process by providing perspective in the choosing of brokers, sponsors, and properties as well as a more in-depth analysis of the DST offering.

The Case for Portfolio Reallocation

We are thrilled to announce the official launch of our newest book: “Alternative Real Estate Investing: The Case for Portfolio Reallocation”! In a world where market conditions are ever-changing and uncertainties abound, Cornerstone is excited to offer investors a roadmap to success through alternative real estate investments. Join us in celebrating the release of this invaluable resource, packed with insights, guidance, and expert advice for those looking to expand their investment horizons and navigate the challenges of today’s economic landscape. Get ready to enhance your portfolio, mitigate risks, and seize new opportunities with “Alternative Real Estate Investing: The Case for Portfolio Reallocation”.

Cornerstone Real Estate Investment Services | Our History

Our unparalleled experience sets us apart, offering you unique insights and perspectives that no other firm can match.

Our EXPERIENCE

Since its beginning in 2002, Cornerstone Real Estate Investment Services has been intimately involved in the alternative investment securities industry. Beginning with the IRS Private Letter Ruling in 2002, we have witnessed its remarkable growth to over $8 billion in sales in 2022 and we have been there every step of the way.

Throughout this journey, we have gained invaluable knowledge about the sponsors, asset classes, and geographic locations that consistently perform well, even in the face of major economic shifts. From the challenges of the Great Recession to market expansions, the global pandemic, war in Europe, and historically high inflation, we have navigated through it all. These experiences have given us a deep understanding of which asset classes perform well and which have had challenges over various economic cycles.

We recognize the importance of aligning with sponsors who possess not only the expertise but also the genuine care to protect and grow your investment. With our insights and relationships, we are committed to presenting you with investment partners, and opportunities, that preserve your capital and provide greater return potential.

cornerstone real estate Investment services | Tax Expertise

A solemn pledge: educate and inform every investor with customized professional services.

Leveraging our in-depth understanding of the tax code and our track record of successfully structuring over 2200 tax-free transactions, we bring forth our unparalleled expertise in capital gain deferrals, tax shelter products, and tax-free charitable giving on appreciated real estate.

cornerstone real estate investment services | Due Diligence

cornerstone real estate investment services | Due DiligenceWe take pride in being your dedicated representatives, committed to safeguarding your investment interests. At the heart of our operations lies a commitment to thorough due diligence. Our offerings undergo rigorous examination and independent testing to ensure optimal performance at every stage of your investment journey.

Our due diligence process has been meticulously crafted to ensure a comprehensive evaluation at every level – from the sponsor to the property, and the offering structure. We leave no stone unturned as we carefully assess various factors, including the sponsor’s performance history, their experience in property management, and their capacity to provide exceptional client service.

To gain a deeper understanding, our due diligence team and/or firms may personally visit properties and engage in interviews with tenants, allowing us to gather valuable insights. Additionally, we thoroughly review appraisals to ensure accuracy and reliability.

When it comes to the offering structure, we conduct a meticulous analysis, considering conservative financial projections, excessive offering load and expenses, hidden tax implications, unfavorable loan provisions, and unreasonable exit strategies. Our aim is to identify any potential risks or drawbacks, ensuring that our clients are presented with the most advantageous investment opportunities.

This approach ensures that only the most promising investment opportunities make it into your portfolio and perform well over the hold period. The ultimate goal of our due diligence process is to preserve your capital, maximize your returns, and provide you with a more peaceful prosperity.

cornerstone real estate investment services | Diversification

At Cornerstone, we believe in tailoring a strategic plan for risk diversification that is specifically designed for you. Our team has developed an innovative software tool that allows us to create a well-diversified alternative investment portfolio, calculating additional tax basis to help shelter cash flow from taxation, and ensure you benefit from a fully tax-deferred exchange.

We strongly advocate for spreading risk across multiple sponsors, asset classes, and geographic locations. While we have created well over 2,000 diversification plans, each one is customized to meet the unique needs of the individual investor. By taking into account your investment philosophy, life and professional experiences, tax position, geographic knowledge, and investment goals, we provide you with a strategic diversification plan that aligns perfectly with your investment goals.

Our extensive experience in the industry enables us to identify the sponsors and asset classes that consistently deliver the best results. Through rigorous due diligence, we thoroughly examine and test the properties offered within these asset classes to ensure they are well-structured and capable of performing throughout the entire investment cycle. We also value your personal insight, life experiences, and investment philosophy, using them to select the most suitable property offerings that will form the foundation of your highly personalized real estate investment portfolio.

We are excited about the potential synergies that can be created by combining our expertise with the insights gained from your own unique journey. Together, we can build a solid investment strategy that maximizes tax benefits, minimizes risk, and aligns perfectly with your financial goals.

50

States Licensed

32

Sponsors

45

DST Properties for 1031 Exchange

11

Opportunity Zones

15

REITs